E14 ft. Balaji Srinivasan on his $1M Bet, Erik's new interview show, and E15 ft. Nic Carter

Hey MOZarts, its been a big week.

We had Balaji Srinivasan on earlier this week for an emergency podcast to talk about his $1M bet, the financial crisis 2.0, the digital devaluation of USD & what comes next.

This weekend, Erik debuted his longform interview show! First episode of Upstream with Erik Torenberg is with Marc Andreessen. Upcoming episodes will be with Balaji Srinivasan, David Sacks, Ezra Klein, Katherine Boyle, Joe Lonsdale, and many more. Please subscribe/download and review the podcast here and below. We’re biased, but this interview with Marc gives the best insight into his intellectual journey over the past decade. Marc discusses how much ideas matter, Burnham, a billionaire mindset, and how to replace elites. Love to hear what you think.

Onto this weekend’s episode of Moment of Zen featuring writer and VC Nic Carter:

Looks like your Sunday is planned out for you ^

Today, we’ll dive deeper into what happened to the US banking system from Balaji’s perspective.

Losing Trust in the System

Balaji raised some critical points about the US banking system and the impact it has had on the public's trust. While the US banking system has traditionally been a high-trust system, recent events have eroded this trust, particularly in the aftermath of the 2008 financial crisis.

And now we have anarcho-tyranny, but for banking. Okay, you have the tyranny of a million insane compliance regulations, but the anarchy of literally not notifying depositors when they know that the money is gone.

He highlights the growing use of sanctions by the US government, which has led to a significant non-dollar economy developing around the world. This trend has implications for the global financial system, as the dollar has long been the dominant currency in international trade and finance. As more countries seek to move away from the dollar, it could lead to increased volatility in the global financial system and potentially even undermine the US dollar's status as the world's reserve currency.

Trust in the media has also been eroded in recent years due to concerns about bias and misinformation. This has implications for the banking system, as the media plays an important role in shaping public perceptions of banks and the financial system. If people don't trust the media, they may be more likely to be skeptical of banks and other financial institutions.

The growing popularity of Bitcoin and other cryptocurrencies may serve as an alternative to traditional banking and finance. Cryptocurrencies offer some advantages over traditional banking, including greater transparency and decentralization but as we’ve seen there are risks, such as volatility, fraud, and regulatory uncertainty, and it remains to be seen whether they will ultimately be able to displace traditional banking and finance.

Balaji remains highly critical of the US banking system and the broader financial system. And there certainly are legitimate concerns about the potential for future bank failures and the erosion of public trust.

We’re in the Endgame Now

“The worst bet in the world in 2021 was betting on the long-term financial health of the United States of America. And the worst be in the world in 2023 is gonna be betting on the short-term health of the United States of America.”

Balaji emphasized the severity of the situation, and it's important to take a closer look at the factors contributing to the system's insolvency and the potential “endgame”.

One significant factor contributing to the system's insolvency is the accumulation of debt. The US has been fighting wars for years, decades, and the cost of these wars has been enormous. This debt, coupled with the practice of printing money, has resulted in a situation where the government owes more than it can realistically ever pay back and its creditors are beginning to internalize this.

Another factor contributing to the system's insolvency is the recent bank runs. These runs are more of a function of the banks not having enough liquidity (i.e. liquid assets) to pay for withdrawals, meaning that they don't have enough cash on hand to cover their customers' demands. This is a significant issue as it raises questions about the health of the banking system and its ability to withstand financial shocks.

To address this issue, the Fed introduced the Bank Term Program (BTFP). This program was designed to provide banks with additional liquidity to cover withdrawals and maintain stability. However, this program has resulted in massive levels of money printing, which could have dire consequences in the future.

“Your mental model is, ‘Oh Balaji, no, there's still money in some of the banks. It's still OK’. My model is there isn't.”

Balaji argues that the reality is that the unrealized losses of the banks are too great, and the BTFP program is simply printing away the debts. In other words, the program is addressing the immediate issue of liquidity, but it's not addressing the underlying problem of insolvency.

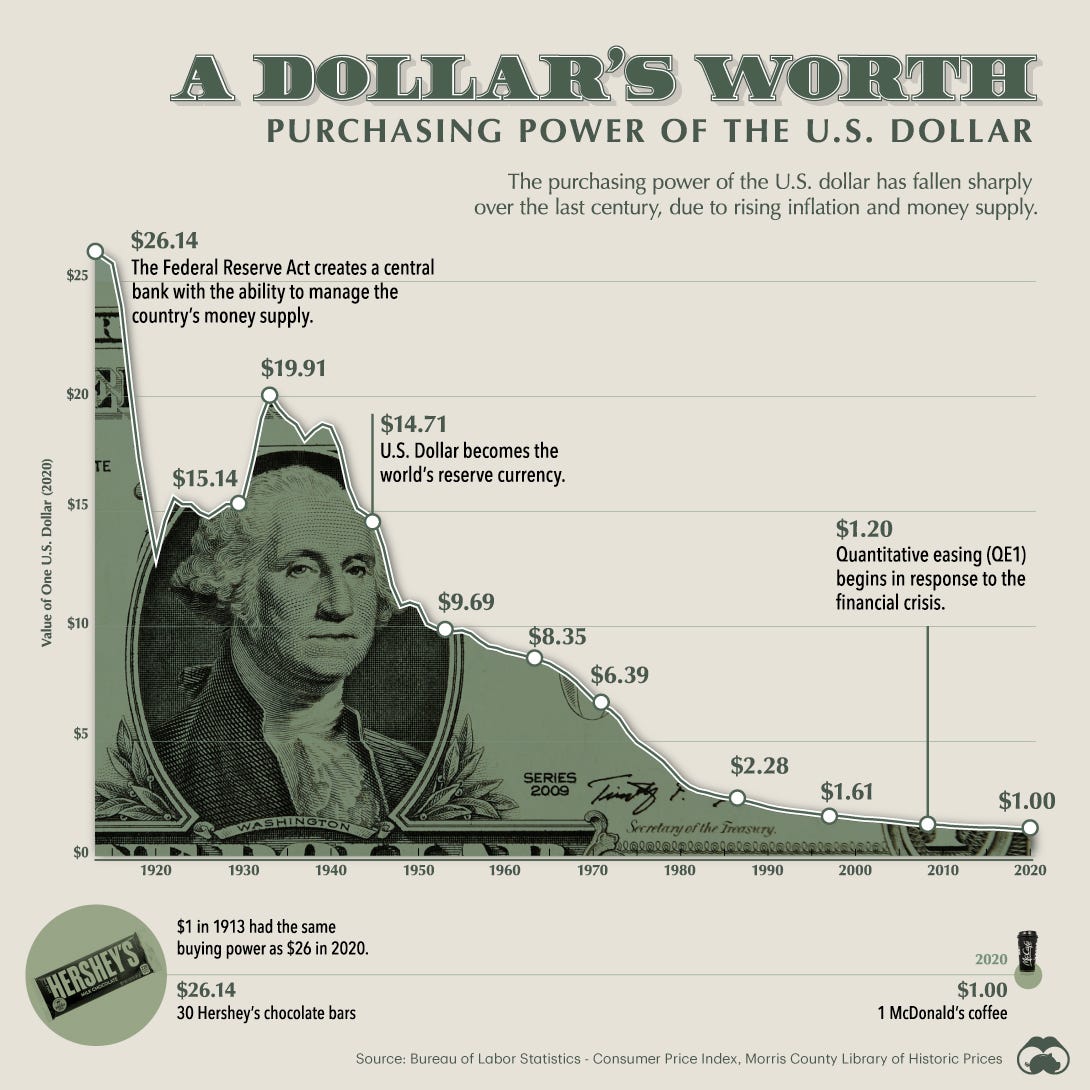

We have seen the implications of massive money printing on the long-term stability of the economy. One such consequence is inflation. As the government printed more and more money, the prices of nearly everything has increased and thus the purchasing power of the dollar was reduced further.

If the US dollar continues to lose value, it could result in a loss of confidence in the currency and a decrease in demand for US goods and services. This could have significant implications for the global economy as the US dollar is currently the world's reserve currency.

What if Balaji is right? What if the endgame of the US banking system is near? We’ve largely ignored the dire consequences of massive money printing, the accumulation of debt, and broader bank illiquidity. We must take a closer look at the financial health of the United States and work to address these issues before it's too late.

Highlighting Youtube Comments

The Good

The Be Better

The Funny

*Dan*

Until next time.

Moment of Zen is still evolving and we want to know what is most valuable to you. What do you want us to talk about or share in this newsletter? Leave us a note in the comments.